As part of your daily routine, you’re working on your physical health. You’ve found a silver bullet for getting physically fit.

It’s Time to Get Financially Fit

Over the last several weeks, I’ve been reviewing the Why of money. I’ve discussed your relationship with money, how money can buy you time, and how to make sure you are working to live and not living to work.

Now it’s time for some How. It’s time to get busy doing daily financial exercises to ‘lean out’ your spending and ‘get buff’ in your saving and investing. Maybe that sounds like a cute analogy, but it’s quite literal. It really works like that.

Just as ‘eat less and exercise’ is the formula for health, ‘spend less and invest’ is the formula for wealth.

Maybe you are in debt and getting deeper. Maybe you are managing month to month, but you’re not making progress. Maybe you are making good money, but you don’t know where it is going, and you are ready to set some concrete goals about financial independence.

This approach will work no matter how many zeros are in your paycheck. It turns out both rich and poor make dumb mistakes with money.

Follow a System

The key is to tap into a system. The system is what will eventually produce significant results. Just like physical fitness, if you do the exercises you will see the results. It’s guaranteed. But you have to want it.

A financial planner will charge a lot of money for this; I know because I’ve tried it. I thought there was something special about working with a professional. It turns out that there isn’t. You pay for them to coach you through several steps, but it turns out there’s nothing mysterious about it, and you still have to do the work. So why not save the money and do it (mostly) yourself?

It’s like what I said about having a fitness coach. It’s great if you can afford it, but it isn’t necessary when you can follow a home workout. Consider this like a home workout program for your personal finances. Let’s all do it together.

Okay, ready? The following is a broad overview of a 4-step plan that will get you financially fit. Within each step are many more details and tasks. But before all of the detail, I want to show you an overview of where we’re going.

Ready, Load, Aim, Fire

Step 1. “Ready” (Financial Assessment)

The first step is to track down all your accounts and put the information in one place so you can see it. Seeing the information is critical. Think of it as your financial scorecard.

When you drive, you use a ‘dashboard’ to quickly see important information such as speed, RPMs, gas level, engine temperature.

You need a financial dashboard

When you’re in a basketball game, important statistics like points, rebounds, steals, fouls, and free-throw percentage are listed on the scoreboard.

You need a financial scoreboard

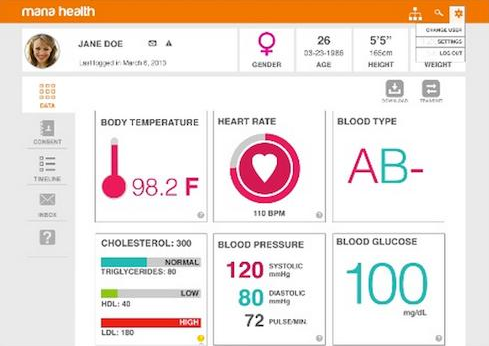

When you go to the doctor, you measure height, weight, BMI, heart rate, blood pressure, cholesterol levels.

You need a financial health report (credit: https://i.imgur.com/wPvaolk.png)

Yet how many of us take the time to do this for our financial life? Not very many. Yet, how can you expect to win the game if you don’t know the score?

Maybe you don’t do it because you really don’t want to know (ignorance is bliss?). The numbers can be depressing. But ignoring them doesn’t help.

- You can’t ignore your fuel level, or you’ll be stranded late at night on a desolate road.

- You can’t ignore your fouls, or you’ll be sitting on the bench instead of playing.

- You can’t ignore your high blood pressure, or you’ll face a devastating stroke.

- You can’t ignore your financial scorecard, or you’ll find yourself in bankruptcy, living paycheck to paycheck, or spending your time (and life) working at a job instead of doing what matters to you.

It’s time to face the facts. Consider it a financial health check up. If the news isn’t good, then at least you know what you are dealing with and can start to fix things. If the news is good, then you can have the confidence to start making plans for living the life you choose.

I will show you how to calculate the two key metrics to building wealth, and will also provide the tools to make it easy.

Step 2. “Lock and Load” (Get Organized and Learn)

Once you know where your money is (or isn’t), it’s time to get organized. This includes simplifying and consolidating if necessary. Finances that are scattered in many locations are hard to manage.

Getting everything together under fewer ‘roofs’ will make life much more convenient and efficient.

It will also be useful to look at the various applications that can help manage and organize. I will give you specific recommendations of what to use.

Finally, I will help you brush up on some of the financial terms and account types that will be important in setting up your strategy.

Step 3. “Aim” (Make a Plan)

This is where I will help you calculate your savings goals, make a budget, prioritize spending, and explore investment strategies.

Your plan will be influenced by what your objectives are. You may want to look at planning for purchase of a car, or home, education expenses for children, and retirement. These all require money in different time frames. Once you know what you are aiming at, it will be easier to define how to get there.

Step 4. “Fire!” (Grow Your Wealth)

Once the plan is in place, it’s a matter of execution. You will want to automate as much as possible. Not only does this save time, it also makes sure it happens so it doesn’t depend on your motivation or emotions. “Set and forget” is a great way to build wealth.

I will help you look at the various types of investment options and how you can set them up to work in your own financial plan.

20 Day Financial Fix

Just like a home exercise plan can jump start your fitness in 4-6 weeks, I want to help you get financially ripped by doing a few important financial exercises each day, five days a week, for 20 days.

If you are interested, sign up for my email mini-course. Also, please share on Facebook and Twitter so others can join us too. Use the hashtag ‘#20DayFinancialFix.’

If you enjoyed this post, please use the share buttons to help other people see it as well. I also appreciate all comments! Enthusiastically agree? Respectfully beg to differ? Have your say here.

Matt Morgan, MD writes about how mastering the first habit is like pushing the power button on your life. Subscribe to his e-mail list and follow him on Twitter and Facebook.

Nice steps and good pics! I think taking stock of what you have (financial assessment) is probably the most important thing to do. First off, many people may not even know how bad their situation is until they look. This may motivate them to then take further action. Others (like PoF) may not realize they are close to retirement and this may also motivate them to take further action. After that, the other stuff will slowly come along. 20 days is definitely enough to start getting the First Habits of financial health together.

I like to call it situational awareness. It very hard to make good decisions without context. For example, a decision about buying a certain car can be a good decision in one case and be a terrible decision in another. The difference is knowing the circumstances.

You can see this thinking in action if you listen to the Dave Ramsey call in show. The first step is the assessment. Most callers don’t have a grasp of their situation. His advice is pretty obvious once he’s confirmed the underlying numbers.